Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

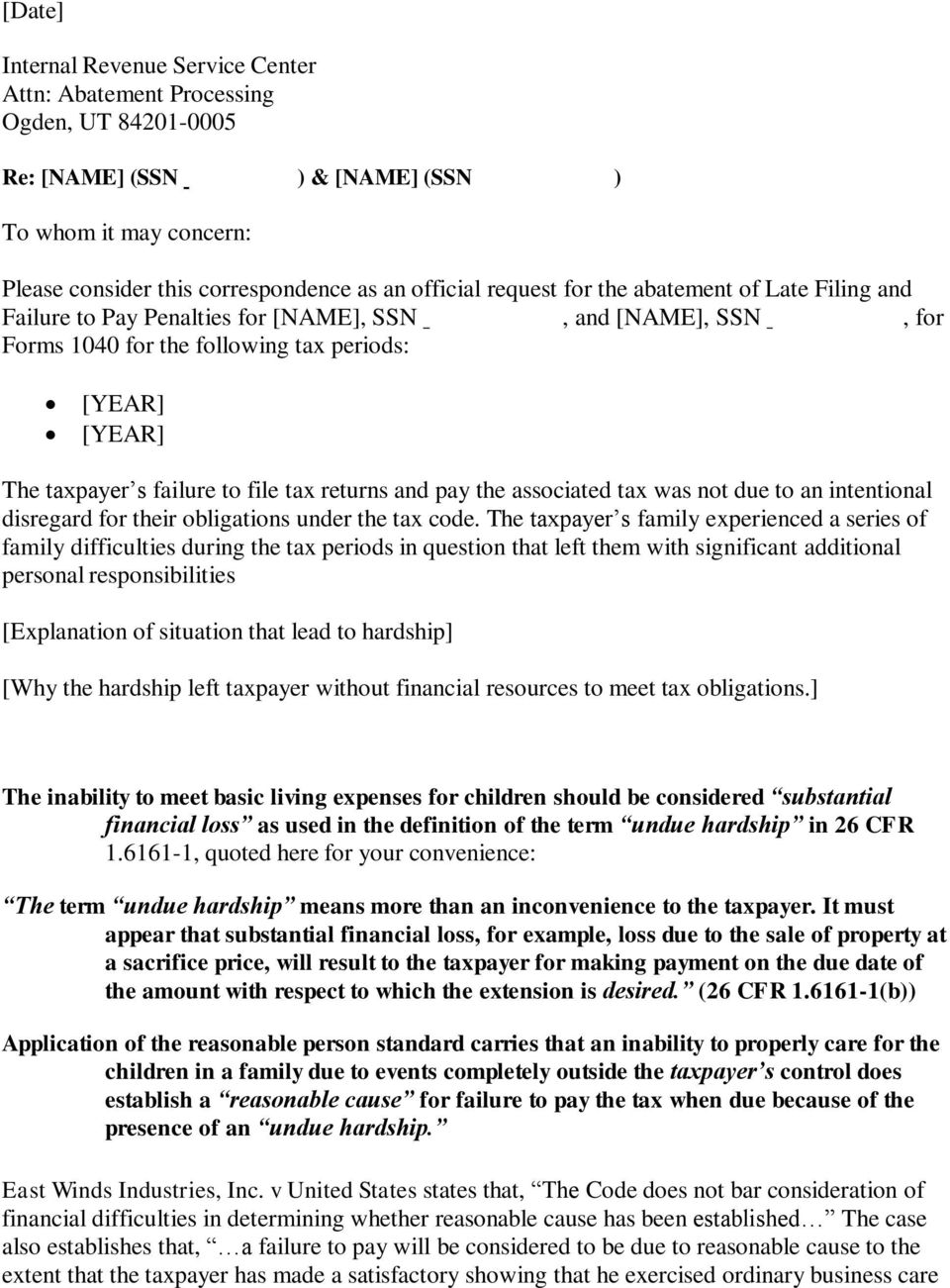

Sales Tax Penalty Waiver Sample Letter / 3 Ways To Write A Letter To The Irs Wikihow / Proper payment of taxes at the correct time is the responsibility of every individual citizen;

Sales Tax Penalty Waiver Sample Letter / 3 Ways To Write A Letter To The Irs Wikihow / Proper payment of taxes at the correct time is the responsibility of every individual citizen;. You can either draft a letter and send it, or call the irs and talk to one of their agents we recommend sending a letter so that you have a paper trail and documentation. The letter we send with the audit package will include our decision on the waiver. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty always ask the merchant if a surcharge applies when requesting cash back at the point of sale. You may also contact us to request a penalty waiver by mailing a letter or sending a secure message. Reviewing a sample waiver letter can be useful before you write your own.

It is super easy method to perfect the skills of writing letters. This sample penalty abatement letter can be used by tax attorneys accountants or cpas and individuals or businesses to provide a guide as to how to write a. The waiver letter or waiver agreement is a document that confirms that a party has surrendered or waived their rights. Use success tax relief's irs penalty abatement sample letter to get you started. Proceed to select 'tax obligation (income tax resident individual)' and then select the 'tax.

Please guide me how to reply to commercial tax penalty letter we already paid penalty.

We've got suggestions in order to help you reveal your best self and a sample you and also, scroll to see an example cover letter you could make use of to craft your very own. Home»free templates»sample letter»9+ tax penalty waiver letter sample. Reviewing a sample waiver letter can be useful before you write your own. If possible look at an example that is similar to what you want. For example, if someone was thinking about going hunting on a gaming reserve, they may have to sign a letter of waiver that states that the owner of. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. The law requires dor to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date. Fillable online state tax waive penalty sample letters fax email. 50 proof of funds letter. Many tasks ask you to file a cover letter along with your other application products, but even if a cover letter is optional, you might take the chance to send one along. Tax letters are generally framed as documents that state the terms and conditions of the taxation procedures. Enter date to whom it may concern. We are writing to request that her penalty for filing irs reasonable cause letter sample.

Sample format for sales tax letter. 50 proof of funds letter. Fillable online state tax waive penalty sample letters fax email. Enter date to whom it may concern. If possible look at an example that is similar to what you want.

The law requires dor to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date.

Use our sample formal waiver letters as templates for your traditional waiver letter. Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for late filing of returns to upload your kra waiver letter under the upload section. We will not grant a waiver unless all reports have been filed and all tax due has been paid. A letter of waiver is any letter that is used to verify that someone has waived one of their rights, or that an obligation out against them has been waived. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Sample format of letter to waive penalty. Moreover some individuals uses internet resources for sample letters to get at learn about the particular and particular format for letter. The law requires dor to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date. See our video explanation below or keep. It should be addressed to the commissioner of taxation as it requests the commissioner of taxation to allow a waiver of the late tax payment and states reasons for the waive of penalty/late payment of tax. Searching summary for sales tax penalty waiver letter. However writing a letter of waiver isnt a 100 percent guarantee that the other party will comply. Attach additional documentation to support your reason(s) for requesting a penalty waiver.

You can use this template as a guide to help you write a letter. You can either draft a letter and send it, or call the irs and talk to one of their agents we recommend sending a letter so that you have a paper trail and documentation. It should be addressed to the commissioner of taxation as it requests the commissioner of taxation to allow a waiver of the late tax payment and states reasons for the waive of penalty/late payment of tax. See our video explanation below or keep. There are two ways to apply for penalty abatement.

What is letter of appeal requesting a waiver of liquidated damages and legal fees?

A form a taxpayer can complete and submit to request relief under the taxpayer relief provisions. Advice for public accounting tax preparers on how to waive exempt organization penalties. Searching summary for sales tax penalty waiver letter. We will not grant a waiver unless all reports have been filed and all tax due has been paid. You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty. For example, if someone was thinking about going hunting on a gaming reserve, they may have to sign a letter of waiver that states that the owner of. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Sample format of letter to waive penalty. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be. For instance, you may be given a citation, a penalty fee, or a new financial obligation. After you find out all sales tax penalty waiver letter results you wish, you will have many options to find the best saving by clicking to the button get link coupon or more offers of the store on the right to see all the related coupon, promote. It is super easy method to perfect the skills of writing letters. You can use this template as a guide to help you write a letter.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Juego Play 4 Para 2 - Los Mejores Juegos De Ps4 Para 2 Jugadores Para Jugar Con Amigos - Play y8 2 player games at pog.com.

- Dapatkan link

- X

- Aplikasi Lainnya

Arteries Diagram - Cross-Section of Artery and Vein | Interactive Anatomy Guide / Arteries and veins diagram 205 circulatory pathways anatomy and physiology.

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar